The very same ideas and algorithm for market entry are fully applicable for exiting the market or taking profits. Here we won’t discuss the case of exiting the market with a stop-loss. And the most important case where this method is needed is trend following.

Standard practice of taking profits is placing a takeprofit order with trailing. Trailing order follows the current market value, being behind it for configured number op pips. At the first glance, the idea is excellent, but the problem is again the market volatility. Trailing order only goes in one direction, so if placed too close to the market, it can be triggered by a pullback. This happens a lot, e.g. because many market operators like to do “stop hunting”.

We suggest using our algorithm to make trailing logic more flexible. To avoid excessive or false triggering, we set the stop level far from the current market level. Basically just over the break-even level. And next we are detecting the local extremes by our algorithm. Once they are identified, we move the stop order close to the extreme. If the market continues moving to the same direction, and we are lucky and the order is not triggered by a pullback, we just repeat the procedure until the stop is triggered.

Trend Following Is Benefitial Only With Accurate Signals

Once the stop is triggered, we are waiting for the next significant extreme in the opposite direction and decide whether we want to re-enter the market in the same direction. This can be lucrative if the trend resumes. However, we can never predict that, so at some point the last re-entry will most probably be a loser.

There is also idea to profit from pullbacks. Which is often called “catching a falling knife”. Which means that having fixed our profit, we open a position in the opposite direction.

This is extremely risky trade, but on strong trends it can be very profitable.

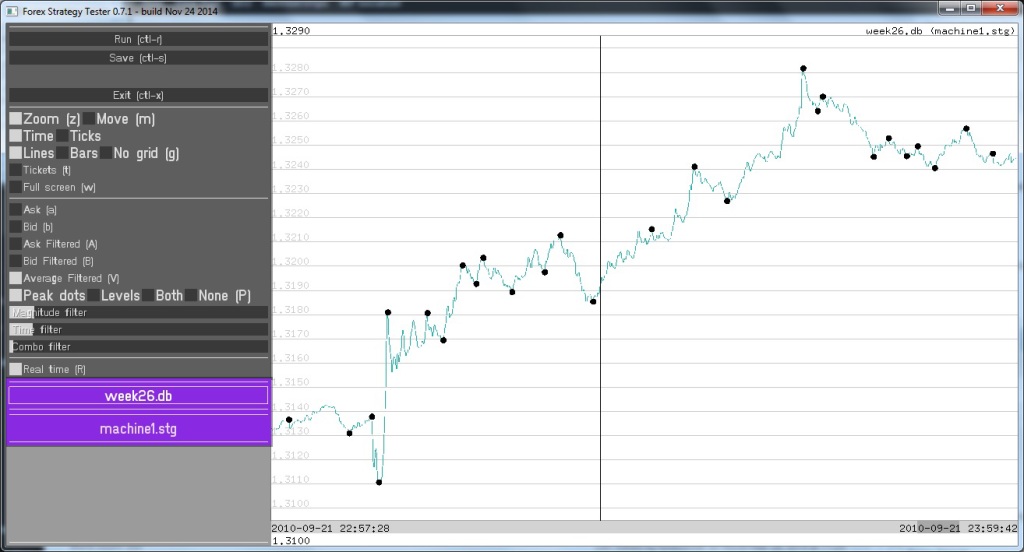

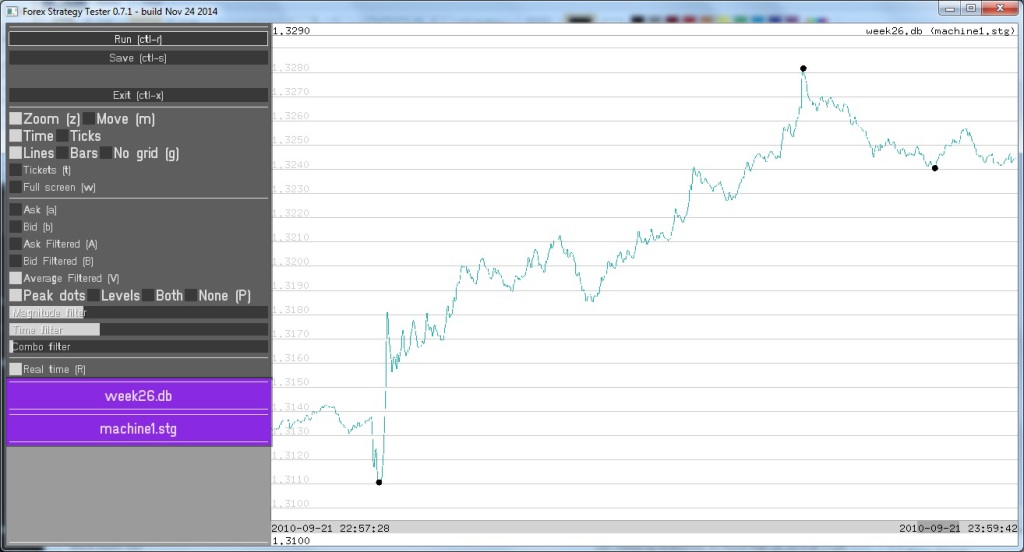

For trend following trading strategy, we use our pivot point analyzer as a trend indicator. As the figure below shows, once we have a trend, the output of the detector is mostly the peaks in the same direction (maximums for the uptrend seen on the screenshot). This, along with other simple geometrical measures makes trend identification quite reliable.